Standard Chartered is a global bank and provides many financial products to their customers including the credit card. They provide many kinds of credit card to their customers each catering to specific requirements of the customers. Find below the list of credit card types you should check out before applying for the same.

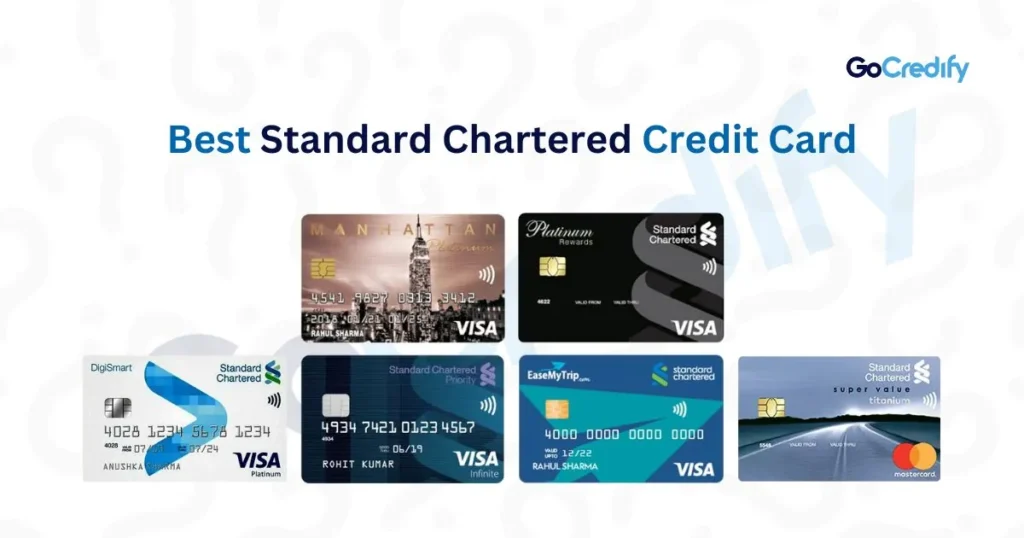

Best Standard Chartered Credit Card 2025

All of Standard Chartered credit cards are quite effective and offer cashback. However, we have selected some of them and listed them here as the best.

Standard Chartered Super Value Titanium Credit Card

Annual Fee: Rs 750+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- 5% cashback on everyday expenses.

- Exciting discounts on dining at selected restaurants.

- 1% fuel waiver at all the petrol pumps in India.

Standard Chartered Rewards Credit Card

Annual Fee: Rs 1000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Access to the domestic lounge access (limited).

- Access to the 1% fuel waiver.

- Availability of reward points with easy redemption options.

Standard Chartered EaseMyTrip Credit Card

Annual Fee: Rs 350 + GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Up to 20% dicounts on booking via EaseMyTrip.

- Limited access to the domestic longue access.

- Reward points on the usage of credit card.

Standard Chartered Manhattan Credit Card

Annual Fee: Rs 999+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- up to 5% cashback on groceries shopping.

- Higher amount purchases convertible into EMI.

- Availability of digital payment option.

- Various travelling offers including booking discounts, hotel deals, etc.

Standard Chartered Platinum Rewards Credit Card

Annual Fee: Rs 250+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Low foreign transaction charges up to 3.5%.

- Cashback offers on selected purchases.

- Reward points on spending for general purchases.

- Simple usage and easy to access.

Standard Chartered Priority Visa Infinite Credit Card

Annual Fee: Rs 10000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Availability of Airport lounge access.

- One can get cashbacks on Airport or train transfers.

- Access to the Travel Insurance.

- Access to the concierge services.

Standard Chartered DigiSmart Credit Card

Annual Fee: Rs 588+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Up to 20% discount on Myntra order.

- Buy 1 Get 1 movie ticket offer in INOX.

- Cashbacks up to 15% on Ola rides.

- Up to 10% discount on Zomato for food delivery.

Standard Chartered Emirates World Credit Card

Annual Fee: Rs 3000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- You can get access to Golf courses and games.

- Offers overseas Insurance to their customers.

- Availability of airport lounge access.

- Expect a 5% cashback on the duty free shopping.

Standard Chartered Super Value Titanium Credit Card Overview

Standard Chartered Super Value Titanium Credit Card is made for everyday use. It is designed to provide you cashback on daily expenses which can include utility payments, fuel expenses, etc. If you are a working person and looking for a daily use credit card to get exciting cashbacks and discounts then this is the card you can choose.

Standard Chartered Ultimate Credit Card Overview

This Ultimate Credit card is premium in nature and is ideal for individuals who prefer luxurious experience. If you are a frequent traveller looking out for good benefits and deals then make sure you check out this credit card. One can use this to enhance their lifestyle and grab some reward points in return as well.

Standard Chartered Rewards Credit Card Overview

As the name suggests, one can expect some rewards while shopping. This credit card offers reward points on every expenses made at the retail outlets. Along with reward points it comes with some more benefits that makes it an ideal credit card.

Standard Chartered EaseMyTrip Credit Card Overview

Standard Chartered EaseMyTrip Credit Card is designed for frequent travellers. It benefits the usual travellers with some longue access and various reward points in return to using the credit card. So, if you are someone who loves to travel and is looking for a credit card get avail some dicounts in return then go ahead and choose this one.

Standard Chartered Manhattan Credit Card Overview

Standard Chartered Manhattan Credit Card is best if you frequently need a card for shopping in departmental stores. If offers some great cashbacks and discounts on Grocery shopping, utility payments, etc. It comes with deals that are hard to resist including the travel offers, EMI options and many others.

Standard Chartered Platinum Rewards Credit Card Overview

Overview: This credit card is made for beginners who is looking for an easy and simple credit card. It is designed for everyday use and expenses including shopping, fuel or utility payments, etc. The card provides various other benefits and deals on travel, dining and many others.

Standard Chartered Priority Visa Infinite Credit Card Overview

Overview: It is a premium credit card specially designed for individuals with a good net worth. It tends to offer premium lifestyle and luxurious experience in terms of exclusive access and rewards points. It is good for people who always prefer high performance services in their life.

Standard Chartered DigiSmart Credit Card Overview

As known by the name, this credit card is especially made for online transactions. It offers various discounts on online shopping and purchases that makes it easier for people who like online purchases. May it be Zomato, Ola, Myntra or any other online platform, this credit card has discounts for every online purchase.

Standard Chartered Priority Visa Infinite Credit Card Overview

This is an exclusive credit card made for people in top tier. It tends to offer premium services and experiences to their customers. If you are someone who like all the premium perks that life has to offer then go ahead and choose this credit card.

Standard Chartered Emirates World Credit Card Overview

This credit card is co branded with Emirates. It provides various travel benefits to their customers. If you are someone who frequently travel with Emirates then this credit card will bring you some great deals and offers that you cannot resist.

Standard Chartered Credit Cards Features and Benefits

There are many standard Chartered credit card types and each one offers various features and benefits. One can grab their hands on some great deals and discounts on utility payments, everyday expenses and many others. Some credit cards are made for shopping while some are made specially for travelling purposes.

Standard Chartered Rupay Credit Card and Standard Chartered Smart Credit Card are designed to provide comfort and flexibility to their customers. There are standard Chartered lifetime free credit card as well for people looking for an all-rounder and affordable credit card.

Standard Chartered Credit Cards Eligibility Criteria

The eligibility for a standard chartered credit card includes the following-

- The applicant should not be a minor and have an age between 21-65 years.

- The applicant should be a resident of India.

- A good Credit score is a must.

- The applicant should have a stable income proof.

Standard Chartered Credit Card Documents Required

The list of the documents are as follows-

- Identity Proof (Aadhar Card, PAN Card, etc).

- Address proof (Aadhar Card, Electricity Bill, etc).

- Income Proof (Salary slip, Income Tax Return, etc).

- Photograph.

- Bank Statement (3 to 6 months).

Standard Chartered Credit Card Annual Fee

The Annual Fee of the credit card changes as per the standard chartered credit card Type. Some Annual Fee can be waivered off if the customer spends a pre-defined credit amount for the same.

How To Apply Standard Chartered Credit Card Online?

Follow the below steps to successfully apply for a standard chartered credit card online-

- Login into the website- The first step is to login into the official website

- Select the Credit Card- The next step is to select the Credit Card Type you want to apply

- Fill in the details- Fill in all the necessary personal details along with the documents mentioned

- Review and submit- The last step is to review the application and submit the same.

Conclusion

These were the details you need to know regarding Standard Chartered credit cards. Each Card is tailored for specific needs and requirements. You can move ahead and apply for a credit card that best suits your needs and lifestyle

FAQs

What should be my salary to apply for a credit card?

The salary of the Applicant should start around Rs 25000 per month.

What should be the minimum age to apply for a credit card?

The applicant should have an age between 21-65 years.

What is the benefit of getting standard chartered credit card?

One can expect a good welcome bonus along with various benefits and discounts