Many banks all over the globe provide credit card to their customers that allows them to raise funds and make payments for expenses with ease. Today, we come with the Credit Card details of one the most leading Bank in India. Yes, you guessed it right! Read further to know more about the ICICI Credit Card Types and Variants.

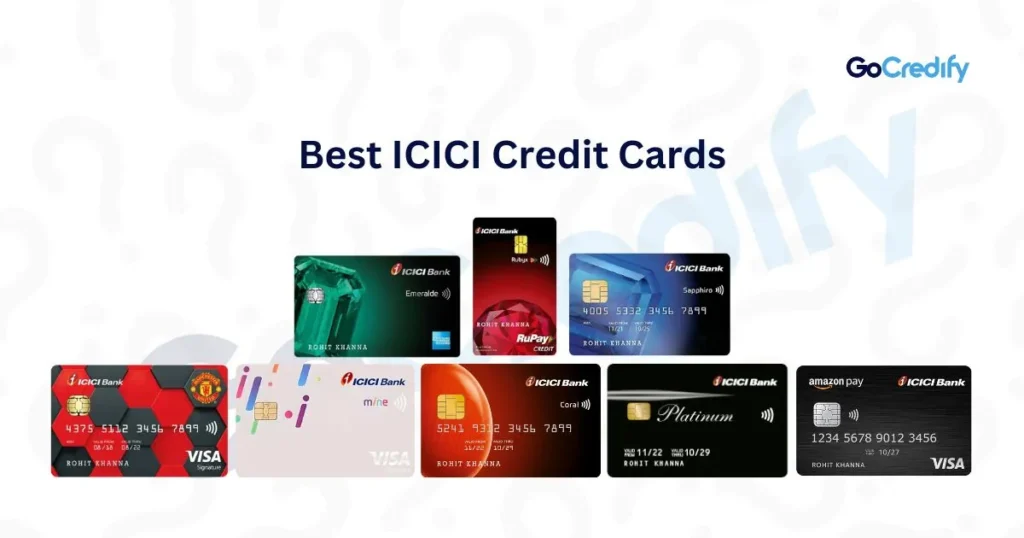

Best ICICI Credit Cards 2025

To make your research even easier, we come with a list of the Top 10 Credit cards in India. ICICI Bank offers one of the best Credit card in India that is suitable for every individual.

Following is the list of Top 10 ICICI Bank Credit Cards:

Amazon Pay ICICI Credit Card

Annual Fee: Rs 0

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Instant Discounts on Amazon Orders.

- Good percentage of Cashbanks on every purchase.

- No purchase amount limit to avail cashback offer.

ICICI Emeralde Private Metal Credit Card

Annual Fee: Rs 12000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Credit Card is accepted globally.

- Bookmyshow offers Buy 1 Get 1 deal.

- No forex transaction fees

- Reward points with the use of card.

ICICI Bank Sapphiro Credit Card

Annual Fee: Rs 3500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Up to 15% discount on selected restaurants.

- Reward points on purchases.

- Best ICICI Credit Card for lounge access.

ICICI Bank HPCL Super Saver Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Great savings on fuel and groceries.

- Up to 15% discount on Food at selected places.

- Many offers and discounts for online shopping.

- Some great discounts while traveling including the ticket bookings, hotel stays, etc.

ICICI Mine Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Good deals on shopping and entertainment.

- Digital process for increased safety.

- Easy accessibility to manage contents of the card

ICICI Bank Rubyx Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Easy Reward Redemption.

- Availability of contactless payment.

- Great deals on Food and Travel (including domestic lounge access).

ICICI Bank Coral Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Easy Lounge access (domestic).

- Availability of contactless payment.

- Reward points on every transaction with easy redemption options.

ICICI Bank Manchester United Signature Credit Card

Annual Fee: Rs 1500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Availability of contactless payment.

- Offers Airport longue access.

- Exclusive reward points on purchases.

- Comes with travel insurance.

ICICI Bank Emeralde Credit Card

Annual Fee: Rs 12000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Offers Unlimited lounge access.

- Provides travel insurance.

- Up to 40% discounts at selected restaurants.

- Reward points on every single purchase.

ICICI Bank Platinum Credit Card

Annual Fee: Rs 12000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Up to 15% discounts on selected restaurants

- Contactless payment

- Great cashback offers on everyday expenses

Amazon Pay ICICI Credit Card Overview

The Amazon Pay ICICI Credit Card is introduced by the ICICI Bank in partnership with Amazon. This credit card is for the one who love to shop from amazon and are constantly looking for some cash back or discounts. As the card is free of charge, it attracts many members of amazon prime as well as non prime To get this ICICI credit card so that they can enjoy amazon shopping and receive some great cashbacks for the same.

ICICI Emeralde Private Metal Credit Card Overview

ICICI Emeralde Credit Card is specially made for the top tier population who seek all the premium services. In order to get a premium lifestyle, this card comes in two variants namely the Amex and Mastercard. The credit card is a perfect fit for the ones who need luxurious treatment without compromising anything.

ICICI Bank Sapphiro Credit Card Overview

Are you someone who enjoys all the perks that the life has to offer? Coming with 2 options- American Express and Mastercard, the ICICI Bank Sapphiro credit card offers you the premium lifestyle may it be food, travel or health included. It is a best fit for someone who usually travels and enjoys all the available amenities.

ICICI Bank HPCL Super Saver Credit Card Overview

This credit card was launched to make your everyday life easier. It is best credit card to save a great deal on fuel, groceries and many other expenses. The card is easier to access and offers you various reward points for all the expenses that you make in your daily life.

ICICI Mine Credit Card Overview

With a view to have a credit card for a younger generation as well, the ICICI Mine credit card comes with great deals and offers across various categories that youngsters can customize themselves through the ICICI iMobile Pay App. As it is done digitally, youngsters can easily handle the settings of the Card as per their preference through the mobile app.

ICICI Bank Rubyx Credit Card Overview

There are many individuals who look for a credit card just to enjoy their life, have food at a good restaurant, and shop without looking at the price tag. Along with all this, they also look for a good discount or rewards to save something as well. If you think that this individual is you, then go for the ICICI Bank Rubyx Credit Card.

ICICI Bank Coral Credit Card Overview

The ICICI Bank Coral Credit Card is a combination of convenience and premium lifestyle. This credit card is made for the individuals who seek for a good lifestyle but also expect good discounts at every expense. If you are looking for a good living at a nominal Fee and look for benefits in return, then this credit card is made for you.

ICICI Bank Manchester United Signature Credit Card Overview

As the name suggests, this credit card is made for the individuals who like football. It is specially made for the Manchester Fans. Though, the benefits of the Card are not just limited to football but also it offers some great deals on Food, travel, etc.

ICICI Bank Emeralde Credit Card Overview

This credit card has a bit similar benefits like the Emeralde Private Metal, expect that this card has a plastic body to it. The card is made for top tier population who seek premium services in all the categories may it be food, shopping or any others.

ICICI Bank Platinum Credit Card Overview

ICICI Bank Platinum Credit Card is suitable for every individual who is looking for a credit card with a minimum Annual Fee. It is a simple and basic credit card that comes with benefits and rewards.

How To Apply for an ICICI Credit Card Online?

Below are the steps one must follow to easily apply for a credit card online-

- Log into the official ICICI Bank website or application.

- Move towars the Credit Card section.

- Select the ICICI credit card Type.

- Fill out the application form with all the details like personal details, income details, etc.

- Upload all the required documents like the Aadhar Card, income proof, Address proof, etc.

- Review the application and submit the same for approval.

- Track the approval status through the same website or application.

One must follow all the steps to successfully get a credit card online. After the approval, the credit card will be delivered to your given address.

ICICI Credit Card Eligibility

Below are the details to check the eligibility to apply for an ICICI credit card-

- The applicant age should be 23 or more.

- The applicant should be a resident of India.

- The applicant should have a good Credit score and a stable income.

One must always check the eligibility before applying for an ICICI Bank Credit Card.

Conclusion

The ICICI Bank Credit Cards offers various deals that are beneficial for every individual. ICICI Bank provides credit cards for various use may it be for premium lifestyle or everyday use. They also provide 24/7 customer support assistance to guide you at the times of need.

Best ICICI Credit Cards FAQs

What should be the income to apply for a credit card?

Anyone can apply for a credit card whose minimum Annual salary is 2.5 lakhs or more.

What are the required documents to apply for a credit card?

The required documents are Address Proof, Income proof and proof of Identity.

Can we withdraw cash from an ATM using ICICI Credit Card?

Yes, one can withdraw cash from an ATM.