HSBC also known as Hong Kong and Shanghai Banking Corporation Limited is a well known Bank. They provide various financial products to their customers including debit cards, credit cards and many others. Since 150 years, Bank has been working towards the upliftment of the economy and assisting customers with their services.

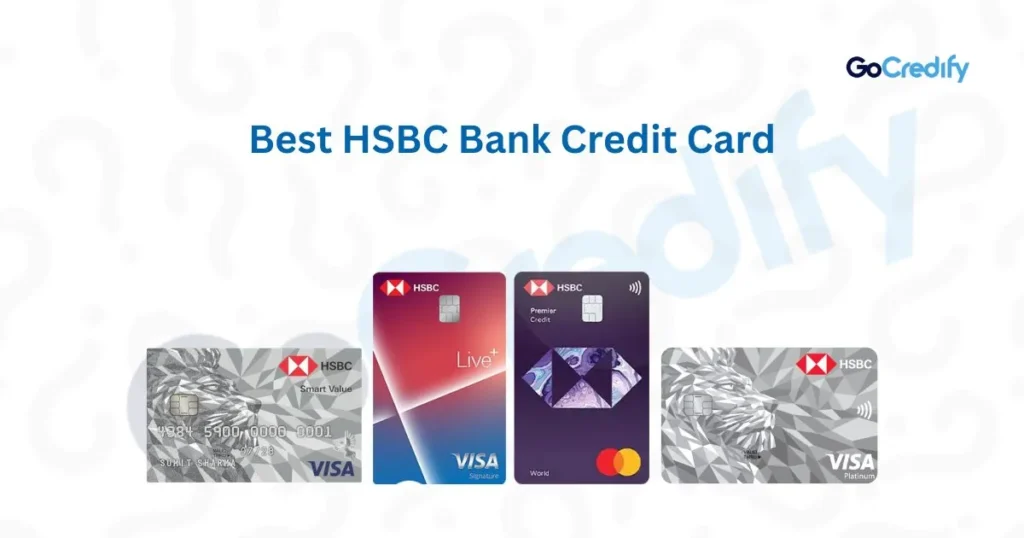

Best HSBC Bank Credit Cards

While having a closer look at the best HSBC credit cards, you will find that each one is unique and provide many benefits to their customers. They are known to provide cashback and reward points for purchases and is ideal for individuals looking for premium experiences or a budget conscious credit card.

Top HSBC Bank Credit Cards List

Below is the list of some of the top HSBC Bank Credit Card you need to check out before starting the application process for the same-

HSBC Live+ Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Welcome reward points worth Rs 500.

- 5% cashback offer on spending at daily essentials.

- Card Tap for instant and contactless payments.

- Discounts on lifestyle experiences including dining, shopping, and movies.

HSBC Visa Platinum Credit Card

Annual Fee: No Annual Fee

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Welcome gift worth Rs 2000 from selective brands.

- Reward points while spending on various categories like groceries, shopping, dining and many others.

- 52 days period where no interest is charged on purchases.

- It comes with global acceptance.

- Card Tap for instant payments.

- Discounts on lifestyle experiences including restaurants, hotels, etc.

HSBC Premier Credit Card

Annual Fee: Rs 3000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Access to domestic and international airport lounge (limited).

- Balance can be transferred at low interest rates.

- 24/7 conceierge support.

- Discounts on dining and travelling experiences.

- Availability of secure and contactless payments.

HSBC Smart Value Credit Card

Annual Fee: Rs 499+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Interest rates are lower on EMIs.

- 50 days interest free credit period on card activation.

- Card Tap and go feature is available.

- Discounts on booking movie tickets.

- Balance can be transferred into HSBC account with minimum 1% interest per month.

- Access to fuel waiver.

All Overview HSBC Bank Credit Cards

HSBC Live+ Credit Card Overview

This credit card is designed to provide offers on everyday essentials. It is ideal for individuals who are looking for a credit card that offers reward points and cashbacks while spending on daily necessities. It allows that customers to have lifestyle benefits like dining discounts, fuel waivers and even entertainment offers. It also provides cashback offers on daily expenses. So, if you are looking for a credit card for everyday lifestyle spending then this should be your pick.

HSBC Visa Platinum Credit Card Overview

It is a premium credit card that is available without any Fee. It is ideal for individuals who want to enjoy all the premium lifestyle experiences like travelling, entertainment, and many others. It also offers discounts while dining with partner restaurants. While looking at its benefits, you will find that the credit card is accepted globally and also offers tap and go feature for secure and contactless payments. Along with all the benefits and privileges you can also get reward points on various transactions while spending or purchasing through the credit card.

HSBC Premium Credit Card Overview

This is a premium credit card that offers many services or privileges to its customers including the HSBC credit card lounge access, dining discounts, insurance coverage and many others. It is ideal for individuals who look for a premium credit card and also expect great reward points and cashback offers in return. The card also offers 24/7 concierge services for requests relating to online bookings, reservations at your favourite restaurants, etc. In short, if you are someone who loves to travel and enjoy luxurious experiences then choose this credit card.

HSBC Smart Value Credit Card Overview

This is a regular credit card that offers many benefits at low interest rates to their customers. It offers cashback and reward points while spending on daily necessities. It also offers benefits like easy EMI conversions, available of contactless payments and even fuel waivers. The customer can also avail the interest free period for atmost 52 days after the credit card arrival.

HSBC Credit Card Features & Benefits

HSBC offers many types of credit cards that provide various features or benefits from their customers. Some of the benefits that they provide are as follows-

- Reward points while spending on daily essentials.

- Access to the airport longue.

- Cashback offers on various categories.

- Card Tap for secure and instant payments.

- Discounts on lifestyle experiences like dining, shopping, etc.

- Availability of fuel waiver at selected fuel stations.

These are some of the benefits but these might vary as per the type of credit card. You can know more details from their official website.

HSBC Credit Card Reward Points and Cashback

HSBC credit card offers their customers reward points or cashback offers depending on their transactions or type of credit card. These are then redeemable with a quick process. Some of the details regarding credit card reward points or cashbacks are as follows:

Reward Points:

Customers can get reward points while spending or making transactions on selected categories like online shopping, dining, etc. These reward points tend to offer customers the flexibility to redeem the reward points on travel bookings, gift vouchers, etc.

Apply HSBC Credit CardsCashbacks:

Customers can get cashback of 5% while spending on daily essentials like groceries, shopping, etc. These tend to provide the customers savings that can help to reduce their monthly expenditures.

HSBC Credit Card Fees & Charges

HSBC charges fees to the card holder. Some of the details regarding fees and charges are as follows-

| Joining fee | HSBC charges a Joining Fee to their customers. The rate can vary as per the type of credit card. |

| Annual Fee | HSBC charges an annual fee for their services to the customers. Some credit cards are available for a lifetime with Rs 0 annual fees. |

| Interest Fee | Depending on your payments history, HSBC charges an interest fee whose rate of interest can vary from 1% to 4% per month. |

These are some of the basic fees and charges. HSBC also charges for more services like foreign transactions, late payment Fee, over limit fee and many others. It is better to know all their charges before applying for an HSBC credit card.

HSBC Credit Card Eligibility Criteria

One must be aware of the eligibility criteria’s in order to successfully avail an HSBC Credit Card. The eligibility criteria for the same are as follows-

- The applicant should at least have a minimum age of 21 years.

- The applicant should be a resident of India.

- It should either be self employed or a salaried person.

- It should have a stable income and a good credit score.

These are some of the basic eligibility criteria’s for any of the HSBC credit card.

Documents Required for HSBC Bank Credit Cards Application

Below is the list of documents that are mandatory to apply for a credit card-

- Aadhar Card

- Income Proof

- Address Proof

- Passport Sized Photograph

One should be ready with these documents before starting the application form.

How To Apply for an HSBC Credit Card?

Follow the below given for HSBC credit card application-

- Login into the official HSBC Website.

- Head towards the credit card services section.

- Select the type of credit card you want to apply.

- Fill in the personal details and documents that are required.

- Confirm the details of the applicant and submit the same for approval.

These are the simple and easy steps that will not take much of your time for HSBC credit card application.

How To Check HSBC Bank Credit Card Application Status?

In order to check the status of your credit card application follow the below given steps-

- 1. Login into your HSBC Bank account.

- 2. Select the credit card section and move towards the Track your Status option.

- 3. Fill in your reference number and the date of birth.

- 4. View your application status successfully.

Conclusion

HSBC Bank offers many types of credit cards to their customers and each provide many kinds of benefits. One can easily apply and avail all the benefits and the services it has to offer. One can visit the official website and check out more details about the various credit cards. You can also contact the dedicated customer care service number to guide and clear all your doubts so that you can find a perfect credit card as per your needs.

FAQs About HSBC Credit Card

Is there any HSBC credit card with no fees?

HSBC Visa Platinum Credit Card does not charge any Joining or annual fee.

What should be the minimum salary to apply for HSBC credit card?

The applicant should have a minimum salary of 400000 annually.

Can I use HSBC credit card out of India?

Some of the HSBC credit card have global acceptance.