Banks provides various services to their customers. They tend to offer convenience in the form of services. One such service, is the credit card. There are many people who just think of applying for a credit card but do not go ahead with the process.

This can be due to lack of knowledge or due to confusion of which ones the best Amongst all. Whatever may be the reason, you need not worry because you are at the right place. We have well researched every credit card and bring to you some top HDFC credit card in 2024.

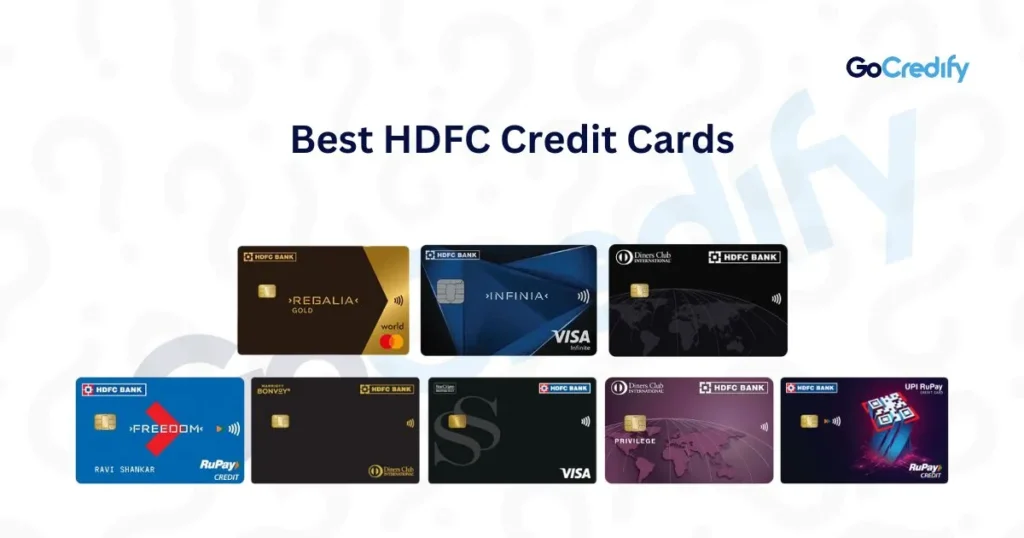

10 Best HDFC Credit Cards for 2025

Below is the list you can go through and be ready to apply for a credit card as this article will clear all your doubts-

HDFC Bank Diners Club Black Card

Annual Fee: Rs 10000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Annual Fee can be waivered off if you spend more than Rs 5 lakhs.

- Reward points for spending on dining, travel, etc.

- Unlimited lounge access.

- Access to golf courses and gold lessons.

HDFC Infinia Credit Card Metal Edition

Annual Fee: Rs 12500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Welcome gift worth Rs 12500 reward points.

- Low mark-up Fee up to 2% relating foreign currency.

- Unlimited airport lounge access.

- Exclusive dining and stay cation offers.

HDFC MoneyBack+ Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Cashback offers on purchases.

- Card Tap for instant and contactless payments.

- No liability, if the Card is misplaced or lost.

- Up to 20% discount through Swiggy dineout.

HDFC Shoppers Stop Credit Card

Annual Fee: Rs 1000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Exclusive discounts and offers while shopping.

- Cashback offers on selected purchases.

- Card Tap for instant and contactless payments.

- High amount purchases can be converted into EMI.

HDFC Bank Marriott Bonvoy Credit Card

Annual Fee: Rs 3000+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Reward points on bookings or Stays.

- Offers complementary Marriott Bonvey Membership.

- Access to selected airport lounge.

- Provides travel insurance coverage.

HDFC Bank Diners Club Privilege Credit Card

Annual Fee: Rs 2500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Card Tap for instant and contactless payments.

- Discounts at luxurious brands.

- Reward points on every transaction.

- Access to insurance coverage.

HDFC Bank UPI RuPay Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Link credit card with UPI.

- Card Tap for instant and contactless payments.

- Cashback offers if transaction done with UPI.

- High amount purchases can be converted into EMI.

HDFC Regalia Gold Credit Card

Annual Fee: Rs 2500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- Welcome gift worth 2,500 reward points.

- 12 airport lounge access every year.

- Up to 2% foreign currency mark-up.

- High amount purchases can be converted into EMIs.

HDFC Bank Freedom Credit Card

Annual Fee: Rs 500+ GST

Key Benefits:

Here are some key benefits of this credit card. Below are the benefits:

- 5% cashback on everyday expenses.

- Card Tap for instant and contactless payments.

- Some percentage of fuel waiver at petrol pumps.

- High amount purchases can be converted into EMI.

HDFC Bank Diners Club Black Card Overview

HDFC Bank Diners Club Black Card is the best Credit Card for salaried employees in India. As the Annual Fee is more, the Card offers great benefits as well. So if you are a salaried individual, frequently travel a lot and over prefer a premium lifestyle that one can go for this particular credit card. So, if you have a good income then only you can make good use of the Card and claim all the benefits and rewards while having a luxurious experience.

HDFC Infinia Credit Card Metal Edition Overview

HDFC Infinia Credit Card Metal Edition is an exclusive card made for the high net worth individuals. One can come in the possession of the card by clearing the HDFC internal standard. This can include having a high income, good credit score and past relationship with the bank. If you meet the standards, HDFC send out an invitation for the Credit Card. So, one cannot directly apply for the same. The credit card is made to give you a premium lifestyle.

HDFC MoneyBack+ Credit Card Overview

There are many people who enjoy online shopping. If you are one of those, then this card is for you. It is one of the HDFC best credit cards for beginners. One can get some great cashbacks and reward points for shopping online may it be through e-commerce platforms like Amazon, Flipkart or Flipkart. The credit card is ideal for everyday expenses as it comes with some unique offers.

HDFC Shoppers Stop Credit Card Overview

This credit card is for the ones who love shopping through Shoppers Stop or its affiliated stores. It tends to provide some great deals while shopping. One can benefit from the credit card during special occasion or sales and grab some great discounts and cashback offers. It is a straightforward card that is simple to manage.

HDFC Bank Marriott Bonvoy Credit Card Overview

This credit card is made with the partnership of Marriott Hotels. It is ideal for people who travel very frequently or for those who like to stay for a vacation at Marriott hotel. It provides some great deals and benefits like checking out late, frequent room upgrades or a complementary breakfast. One can easily apply for this credit card and avail these offers.

HDFC Bank Diners Club Privilege Credit Card Overview

HDFC Bank Diners Club Privilege Credit Card is considered as a premium credit card offering luxurious lifestyle. It is ideal for individuals looking for a premium staycation and fine dining. If you are someone who loves shopping and dining at new places while you travel then choose this HDFC credit card. Along with all the perks, one can also receive discounts and cashbacks at selected brands or restaurants.

HDFC Bank UPI RuPay Credit Card Overview

As the name suggests, this credit card is ideal for people who prefer online banking option and look for UPI payments. This credit card along with the UPI facility, provides standard credit card benefits as well. One can grab their hands on exclusive rewards and cashback offers on various transactions. Is is easy to use and suits well for people who want everything digitally and instantly.

HDFC Regalia Gold Credit Card Overview

HDFC Regalia Gold Credit Card is a premium credit card that offers exclusive discounts. One can avail various lifestyle benefits and earn reward points at the same point. One can also avail various discounts on dining or while shopping from selected brands. The credit card is ideal for individuals who travel frequently or seek premium and luxurious experience.

HDFC Bank Freedom Credit Card Overview

If you are looking for a basic credit card that is designed to giver you a user friendly experience then this credit card should be your pick. It is very simple and easy to operate. The user of the credit card can benefit from the same through various rewards, discounts and cashbacks. As it is a basic credit card, it is ideal for individuals who shop online and pay utility bills. One can expect some great deals on shopping through luxurious brands and benefits through reward points as well.

Conclusion

Thus, as we have seen many HDFC credit card each unique and different in it’s own way, it’s better to contact the HDFC Bank and get in depth knowledge as to what would suit your needs and requirements. Nonetheless, these HDFC credit card types and benefits are smart and well designed to make your life easier and comfortable. So what are you waiting for? Get your ideal credit card now!

FAQs

How to contact HDFC Bank for Credit Card?

One can call on the toll free number of customer care- 1800 1600 / 1800 2600

Which is the best HDFC Credit Card?

One can go for the HDFC Bank Regalia Credit Card.

Can I pay the money immediately after the purchase?

Yes, you can immediately pay the purchase amount.